In India, the real estate sector is the second-highest employment generator, after the agriculture sector. The real estate sector in India is expected to reach US$ 1 trillion in market size by 2030, up from US$ 200 billion in 2021. By 2025, it will contribute 13% to the country’s GDP. The emergence of nuclear families, rapid urbanisation and rising household income are likely to remain the key drivers for growth in all spheres of real estate, including residential, commercial, and retail. Rapid urbanisation in the country is pushing the growth of real estate.

India’s real estate sector is expected to expand to US$ 5.8 trillion by 2047, contributing 15.5% to the GDP from an existing share of 7.3%.

In FY23, India’s residential property market witnessed with the value of home sales reaching an all-time high of Rs. 3.47 lakh crore (US$ 42 billion), marking a robust 48% YoY increase. The volume of sales also exhibited a strong growth trajectory, with a 36% rise to 379,095 units sold.

Indian real estate developers operating in the country’s major urban centres are poised to achieve a significant feat in 2023, with the completion of approximately 558,000 homes.

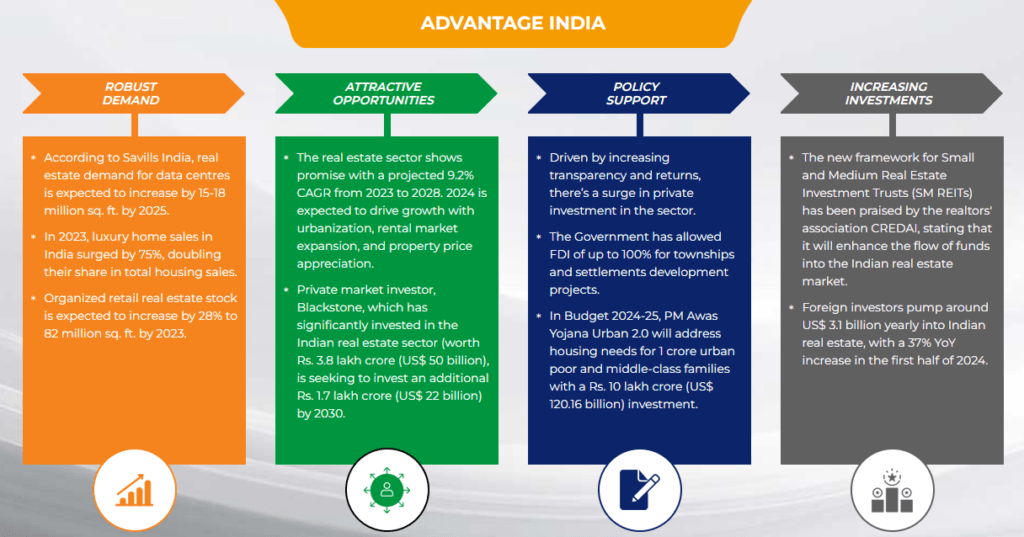

In 2023, luxury home sales in India priced at Rs. 4 crore (US$ 481,927) and above surged by 75%, doubling their share in total housing sales.

For the first time, gross leasing in India’s top seven markets surpassed the 60 million sq ft mark, reaching an impressive total of 62.98 million sq ft, marking a substantial 26.4% increase compared to the previous year. Notably, the December quarter emerged as the busiest quarter on record, with gross leasing hitting 20.94 million sq ft.

The Indian real estate sector witnessed strong private equity (PE) investments of US$ 1.92 billion in second quarter of 2023, demonstrating investor confidence in the market. According to the most recent Investment report from Cushman & Wakefield, this was 63% higher than the previous quarter (first quarter of 2023) and 60% higher than the same time last year.

In July 2023, Delhi-NCR emerged as the third biggest city in the Asia Pacific in having flexible office space stock beating Beijing and Seoul, while Bengaluru retained the top spot, according to real estate consultant CBRE.

The Smart Cities Mission presents a major opportunity for real estate developers by targeting the development of 100 smart cities in India, stimulating the growth of commercial centers in their vicinity. Demand for industrial and logistics space hit a record in 2023, totaling 38.8 million square feet across 8 cities.

Foreign investments in the commercial real estate sector were at US$ 10.3 billion between 2017-2021. As of February 2022, Developers expected demand for office spaces in SEZs to shoot up after the replacement of the existing SEZs act.

Private market investor, Blackstone, which has significantly invested in the Indian real estate sector worth Rs. 3.8 lakh crore (US$ 50 billion) is seeking to invest an additional Rs. 1.7 lakh crore (US$ 22 billion) by 2030.

India’s Global Real Estate Transparency Index ranking improved by three notches from 39 to 36 since the past eight years from 2014 until 2022 on the back of regulatory reforms, better market data and green initiatives, according to property consultant JLL.

According to Savills India, real estate demand for data centres is expected to increase by 15-18 million sq. ft. by 2025.

Foreign investors pump around US$ 4 billion yearly into Indian real estate, with a 20% YoY increase in foreign inflows in 2023.

Technology companies held the highest share in leasing activity at 22% during first quarter of 2024.Engineering and manufacturing (E&M) companies accounted for 13%, and banking, financial services and insurance account for 12%. Flexible space operators increase by 48%, showcasing their notable contributions.

In 2023, India’s residential sector saw record sales and new property launches, overcoming concerns about monetary tightening’s impact on housing loans. Major banks disbursed about Rs. 2.7 lakh crore (US$ 32.45 billion) in credit by January 2024, an annual increase of around 37%.

In the FY23, approximately US$ 24.1 billion was gathered from stamp duty, land revenue, and registration fees

Home sales across top eight cities in India surged 68% YoY to reach ~308,940 units in 2022, signifying a healthy recovery in the sector.

According to the Economic Times Housing Finance Summit, about three houses are built per 1,000 people per year compared with the required construction rate of five houses per 1,000 population. The current shortage of housing in urban areas was estimated to be ~10 million units. An additional 25 million units of affordable housing are required by 2030 to meet the growth in the country’s urban population.

The Government of India has been supportive towards the real estate sector. In August 2015, the Union Cabinet approved 100 Smart City Projects in India. The Government has also raised FDI (Foreign Direct Investment) limits for townships and settlements development projects to 100%. Real estate projects within Special Economic Zones (SEZ) are also permitted for 100% FDI. Construction is the third-largest sector in terms of FDI inflow. FDI in the sector (including construction development & activities) stood at US$ 60.53 billion from April 2000-March 2024.

In FY24 export from SEZs reached US$ 163.69 billion. Exports from SEZs reached US$ 157.2 billion in FY23 and grew ~28% from US$ 133 billion in FY22.In the first-half of 2021, India registered investments worth US$ 2.4 billion into real estate assets, a growth of 52% YoY.

Share of the top listed developers in the Indian residential market is expected to increase to 29% in FY24, from 25% in FY21, driven by a strong pipeline for residential project launch.

Between July 2021-September 2021, a total of 55,907 new housing units were sold in the eight micro markets in India (59% YoY growth).

In 2022, housing sales in the NCR surged 67% to reach 58,460 units compared with the same period last year.

In October 2021, Chintels Group announced to invest Rs. 400 crore (US$ 53.47 million) to build a new commercial project in Gurugram, covering a 9.28 lakh square feet area.

Government of India’s Housing for All initiative is expected to bring US$ 1.3 trillion investments in the housing sector by 2025. Since 2019, 122.69 lakh houses have been sanctioned and 71.57 houses have been completed and delivered to urban poor under the Pradhan Mantri Awas Yojana-Urban (PMAY-U).

The scheme is expected to push affordable housing and construction in the country and give a boost to the real estate sector. On July 09, 2020, Union Cabinet approved the development of Affordable Rental Housing Complexes (AHRCs) for urban migrants and poor as a sub-scheme under PMAY–U.

In October 2021, the RBI announced to keep benchmark interest rate unchanged at 4%, giving a major boost to the real estate sector in the country. The low home loan interest rates regime is expected to drive the housing demand and increase sales by 35-40% in the festive season in 2021.

Government has also released draft guidelines for investment by Real Estate Investment Trusts (REITs) in non-residential segment.

The Ministry of Housing and Urban Affairs has recommended all the states to consider reducing stamp duty of property transactions in a bid to push real estate activity, generate more revenue and aid economic growth.

In July 2021, the Securities and Exchange Board of India lowered the minimum application value for Real Estate Investment Trusts from Rs. 50,000 (US$ 610.7) to Rs. 10,000-15,000 (US$ 122.13-183.2) to make the market more accessible to small and retail investors.

Leave A Comment

You must be <a href="https://estatehustler.com/wp-login.php?redirect_to=https%3A%2F%2Festatehustler.com%2Findian-real-estate-industry-analysis%2F">logged in</a> to post a comment.